China market entry strategy in 2023: 10 Things You Need To Do For Your Brand

As China scraps its zero COVID policies, 2023 is set to see China open itself up to more international businesses. What products will most likely succeed in this new landscape after China’s three years of relative isolation?

One trend that does not seem to be stopping despite China’s end of the zero COVID policies will be the accelerated development of e-commerce technology. The launch of the digital RMB signals the government’s commitment to positioning China as the world leader in e-commerce infrastructure. Loosening regulations on the previously heavily scrutinized tech space has already initiated a rush of investments into big tech. Tech products, both hardware and software, will likely see healthy demand in China’s market in 2023.

According to the 2023 McKinsey China Consumer Report, during China’s zero COVID policy, consumer confidence plummeted while the middle class’s savings grew. As China exits zero COVID, the government will aim to encourage consumer spending to prop up domestic consumption. Domestic and international brands offering products in the luxury and premium category can expect success provided their products are unique, high quality, and well localized for the Chinese market (think bio-active honey or products with established name recognition in China).

International brands looking to take advantage of this critical opportunity for establishing their business in China must create strategies for localized branding, communication, e-commerce, and traditional distribution. These will require a deep understanding of Chinese consumer behavior habits and consumer profiles as well as knowledge of local marketing and operation tools.

Wondering how to start building your China market entry strategy? To begin we suggest doing Chinese market research and reviewing local strategies and trends that have already been proven to work:

- Establish a strong online reputation

In 2022, over 1 billion Chinese people accessed the internet, making China’s digital population the largest in the world. Having a strong digital presence is a must for any brand looking to succeed in this landscape. Ensure your website is localized – this means fully translated including Chinese metadata and tags, with local domain and hosting, optimized for mobile (most people in China access the internet via mobile), and searchable on Baidu. - Marketing and ad placements on Chinese social media platforms

Due to China’s great firewall, a strong digital presence on China’s domestic social media platforms is essential for targeting Chinese audiences. Understand the various demographics found on major platforms like RED (Xiaohongshu), Douyin, WeChat, Weibo, Kuaishou, and Bilibil before tailoring your marketing and ads for each platform. - KOL marketing

A KOL, or key opinion leader, is the Chinese term for an influencer. KOL marketing is prominently used in China to not only increase a product or brand’s exposure but also to localize marketing for international brands, inspiring trust and familiarity among Chinese consumers. - KOC marketing and product seeding

KOCs, or key opinion consumers, are influencers who review products within a specific niche. Unlike KOLs who are usually celebrities, KOCs provide consumers with a more relatable point of access for brand marketing campaigns, demonstrating to consumers how end users engage with a product. Brands reach KOCs via product seeding. - Establish your brand’s e-commerce sales channels

As of 2023, China has the world’s largest e-commerce market, with an extremely mature logistics infrastructure to support it. China’s e-commerce has also become so closely interconnected with Chinese social media platforms that the term social e-commerce was coined to describe it. Major platforms include Alibaba’s Taobao and Tmall, JD.com, Tencent’s Weidian, and e-commerce integrated social media platforms such as Douyin and RED. - Livestream sales

Livestream sales is a trend uniquely successful in China. In 2022, livestream sales accounted for over 10% of e-commerce revenue in China. It offers consumers an immediate and interactive shopping experience along with discounts and flash sales. Popular platforms for livestream sales include Douyin, RED, WeChat live, Taobao live, and Kuaishou, all of which offer seamlessly integrated livestream ecommerce functionality such as one click purchases.

Now that you’re familiar with localized Chinese marketing strategies, let’s talk about how to fine tune and optimize a complete China marketing strategy for your brand in 2023.

10 Tips from HI-COM to Optimize Your 2023 China Marketing Strategy:

1. Competitive Marketing Study and Benchmarking Analysis

Every marketing plan should begin with benchmark competitors, and the Chinese market is no different.

Often, the biggest mistakes foreign companies make in this market is a result of their lack of knowledge and/or underestimation of the local competition. For example, brands come to China with a vision to be a perfect fit in the Chinese consumers lives, but sometimes they do not take into consideration that similar products might already be present in the local market ( with a much lower price), or that the foreign version of the product is not appealing to the Chinese locals.

Mapping out the opportunities, exhibiting challenges and external development conditions are the elements you need to look at firstly. Here at HI-COM we can help you to do a full comprehensive research of these and more elements.

What are other elements you must pay attention to when doing market research in China:

- Market size and the size of your niche

- Buyer persona in China, general rules of consumption in China

- How can your USP be localized and presented on the Chinese market?

- Communication strategies of your competitors

- Distribution models of your competitors

- Future trends and changes that might affect your business in the next 2-3 years.

- Do the technical research on import and logistics, there are products forbidden for importing in China!

Examples of Western and Chinese Market Differences:

In an interview to HBO TV Channel, influencer, Mr. Bags, mentioned that luxury brands often reach out to him for the promotion of “western looking” products for Chinese consumers. However, he tells these brands to not launch their products in China or to instead create a different version of this product customised to the local taste.

In the automotive market, miniature versions of cars are very popular in heavily populated cities of Europe. Therefore, one would assume that in a city such as Beijing where there is lots of traffic, very few parking spaces, and pollution is a big concern, that smaller cars would be a big hit – but surprisingly they’re not. As a result of this, the Smart line of cars were discontinued in China, and are instead now in the process of improving their USP by working together with Geely on a brand new electric car – which will appeal to a completely different type of customer.

2. Localize Your Unique Selling Proposition

Bands should keep in mind that those products and services taking Instagram (or other foreign media channels) by storm, might not actually be very popular in China, and vice versa. The Chinese market is essential for most luxury brands, as well as digital product brands such as Apple, on-the-go brands such as Starbucks, lifestyle brands such as Ikea, and many more. However, it should also be noted that all of these brand successes came with experience and understanding of the different needs of foreign markets.

Bands should keep in mind that those products and services taking Instagram (or other foreign media channels) by storm, might not actually be very popular in China, and vice versa. The Chinese market is essential for most luxury brands, as well as digital product brands such as Apple, on-the-go brands such as Starbucks, lifestyle brands such as Ikea, and many more. However, it should also be noted that all of these brand successes came with experience and understanding of the different needs of foreign markets.

What can you do to assure your product or service is localized for the Chinese market?

- Understand the consumption habits and how business is conducted in China, especially in your category.

- Do not stop at desktop research, arrange focus group to really grasp the essence of Chinese consumer insight. Include as many questions about your product or service as possible, from packaging to usage, to customer journey and experience, to why would people would recommend or not recommend your product or service to friends.

- Use the insight collected, change the product or service accordingly before entry to the market.

Examples of good localization strategies:

By understanding the concept of “面子/mianzi” or “keeping the face”, Apple made millions by providing Chinese people the opportunity to tell their friends that they are “rich” by only investing one or two thousand dollars on a new model of the phone. Of course there were many other reasons that made Apple so popular in China, but it is astonishing to see how the vast majority of citizens using the subway have the newest model of the iPhone every year – but each time no longer than a week after its official release.

When Starbucks came to China it realised that people were not interested in the coffee-to-go concept but rather the “here to stay” idea, so they immediately restructured their space into big comfortable communal areas so to accommodate their young customers. Starbucks also realised that in the larger cities, the younger generation needed a place to “hang out” with their friends.

As the country rapidly develops, the generations are growing up with very different values, which leads to a lack of common interest within families.

3. Localize Your Brand

It is important for brands to develop a reputation in order to enter the Chinese market. Many variables go into the making and localizing of a brand name, therefore, it is vital to come up with a name that associates the message that your company wishes to convey. It is also important for companies to be aware of how the name translates into other languages.

Brand name translation is implemented in 4 main steps: brand image consideration, knowledge of a target audience, benchmark of brand names of existing competition, and linguistic aspects of the new brand name.

This might sound obvious, but companies must know who their target audience is.

Next, you need to localize the communication when entering the Chinese market. Localization is the process of adapting or recreating a company’s marketing materials to fit another market so that it appears natural and effortless. This can include a variety of actions, from translating the content to changing fonts and images.

The purpose of localization is to make the product feel as natural as possible in the hands of the new users. Companies should make sure that their marketing strategies are aware of cultural customs/languages, because if Chinese marketing materials seem unnatural or unprofessional to the online user, chances are, they will be less likely to take an interest in the product or service.

Other elements to pay attention to when working on brand localization:

- Creation of communication strategy that answers the questions: who are you reaching, what message are you sending and what do you hope to achieve?

- Creation of editorial plan using Chinese digital tools and SM platforms.

- Creating localized content for your brand, including text and visuals.

- Setting up measurable KPI.

- Reviewing your competitors communication strategies on monthly basis.

- Creating promotion strategy using paid (ads) and earned (KOL, PR) media channels.

Interested in brand localization services for the Chinese market? Shoot us an email!

4. Align Your Goals with Budget Wisely

One of the most common mistakes a brand can make is planning to go after a whole country, without realising its size. For example, a lot of brand owners can’t name more than 5 Chinese cities, but yet plan to target every person in China.

However, the problem with targeting a whole country like China, is the expense of such a large promotional campaign. China is also home to 56 different ethnicities each with different values, different everyday habits, and contrasting opinions. Therefore, it is almost impossible to target every city in China, unless your brand has a multi-million dollar annual marketing budget and an outstanding product/service retail price.

According to Jing Daily, In China in 2021, yearly marketing budgets on average have grown to around $100,000 on the low end and over $1,000,000 on the high end. This doesn’t mean that you can’t achieve any results if you don’t have these resources. It rather means that you need to be realistic with your goals and expectations. Set your marketing priorities and follow that list from most to least important.

Some of the advices HI-COM’s marketing team can give is:

- Learn what metrix to look at in order to keep your hand on the pulse of the business. For example, mid-size premium brands are not looking at amount of followers they have, but rather on engagement levels of their audience.

- Have a clear idea of long term and short term marketing strategies and allocate resources (and budgets) accordingly. Overstocking products that have expiration dates in China can be a very expensive mistake. Even if it is more costly to produce and transport smaller amounts of products, it is still cheaper in the long term.

- Make research on the most trendy marketing and sales ways. See what new media is suited for your brand.

5. Accept that in China People Don’t Lack any Type of Products

This point is vital for any company aiming to enter the Chinese market. Brand’s should realise that China is not a third world country where imported products are being fought for, but it is actually referred to as the “factory of the world”, and has extremely rich resources – sometimes even things unheard of by Westerners, including imported and local items. Therefore, it is important to do thorough market research when planning to enter the Chinese market to have a clear picture of any gaps in the market and to understand why your product could benefit the Chinese market.

When working on your Chinese market entrance plan, be sure that your brand positioning doesn’t begin with “because we are an imported brand..”

6. Develop an Education Content Marketing Strategy

Many foreign brands have succeeded in China with products that were previously unknown to the Chinese population. At the beginning, McDonalds, Nespresso, and Rexona all struggled in the Chinese market and had do a lot of research and customer education in order to introduce their products/services into the habit of local people.

Many foreign brands have succeeded in China with products that were previously unknown to the Chinese population. At the beginning, McDonalds, Nespresso, and Rexona all struggled in the Chinese market and had do a lot of research and customer education in order to introduce their products/services into the habit of local people.

The benefits of products such as coffee, chocolate, imported wines and spirits, energy drinks, avocados, pastries, etc. had to be presented to the public in a sensitive and educational way. Brand still do this today, for example, influencer Viya, has recently been informing people on her livestreams why they “can’t live without” products such as dental floss and facial massagers, and selling thousands of items within minutes.

7. Use a KOC (Key Opinion Customer) and product seeding marketing tactics

There is no better marketing than “word of mouth”. A good (or bad) word of mouth message can be spread faster throughout communities than any type of advertising. To encourage this, it is not enough to just have a great product, but instead, brands must provide appealing offers.

Local Chinese brands are champions when it comes to word of mouth marketing. Chinese brand, Perfect Diary, uses a great scheme to stimulate its sales. For example, when a customer buys one of their items for 99 RMB (12 USD) he/she then has an option to get a second complimentary product for 1/10 of the price. Every order they process includes samples of their new products. Perfect Diary was one of the highest selling brands in 2019 after the Double 11 festival, and has only grown since. The sales revenue of the brand at Double 11 spiked up to 80,000,000 RMB, and the brand was 7th place in the list of most popular cosmetics of the Double 11 festival (the first among Chinese brands).

Foreign brands entering the Chinese market should consider providing a good deal or offer. Whether that means offering competitive prices, an extra service, or an upgrade – it will beat any other long-term marketing tactics.

Learn more about KOC marketing and how to get started with it here

Product Seeding is another way to use KOL and KOC marketing “on the budget”. Product seeding happens when brands send free products to influencers and content creators with the hope of getting free or law-cost media coverage. This means that the brand has no say in what will be published by KOL or KOC. Product seeding is a great way to earn low cost or even free word-of-mouth marketing in China. But there are some details you need to pay attention to. Here are some tips from HI-COM influencer outreach managers:

- Chinese KOLs and KOCs prefer working with known brands, and seeding campaign will be more successful for bigger international brands.

- Chinese influencers are quite professionals, but select your talents carefully, there are still many fake accounts and agencies out there!

- Sometimes the gifts sent to KOLs and KOCs are not published on their pages at all, but this doesn’t mean that the product was wasted. You have started to build the relationship with valuable resources and that’s what matters.

- Chinese KOL’s have their own style of reviewing and publishing content, so don’t be surprises by creative or overly traditional posts about your brand.

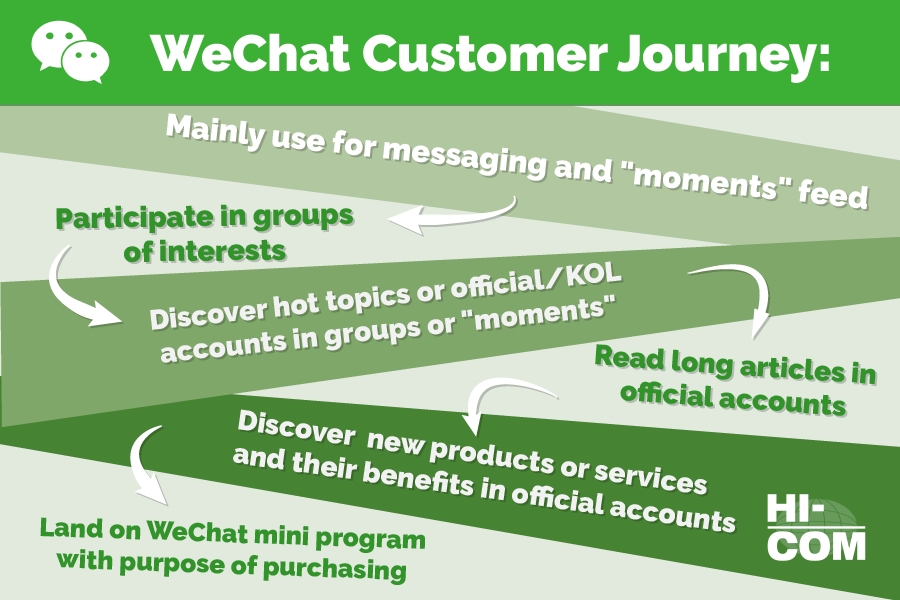

8. Learn about the Customer Journey in China

When entering the Chinese market, it is very important to consider the conversion funnel and customer shopping habits for different products and services in China. Companies should make sure that their marketing strategies are adapted to the cultural customs and way of life of the market they’re targeting.

For example, is your product more suitable for RED (Xiaohingshu) or WeChat Mini-program customers? To answer this question, you need to find out who uses these apps and why.

It is important to be clear on the demographics of the most-used apps and platforms in China, for example, the business focus and the best-suited industries, etc.

When targeting a specific group of customers, brands must understand every aspect of the customers’ life and find a way to fit in with it.

9. Groups, Private Traffic and New Media Marketing Strategy

In 2021, the Chinese consumer is more service-oriented than ever before. For example, it is a well-known fact that Chinese customers are very demanding, as they expect amazing service 24/7 and this service must make the customers’ lives easier. Customers are now expecting an even more personalised service.

In 2021, the Chinese consumer is more service-oriented than ever before. For example, it is a well-known fact that Chinese customers are very demanding, as they expect amazing service 24/7 and this service must make the customers’ lives easier. Customers are now expecting an even more personalised service.

In 2021, like many other brands, Luckin coffee in Shanghai began to increase its customers via private location groups (dependent on the store location). These groups are used for promotions, announcements of pop-up events and sales, weekly draws, mini-games, and other online products.

How does it work for most brands and why should they care? By the end of 2020, brands started to pay more attention to the customer journey and brand discovery of WeChat. A big problem for companies was their low following of WeChat official accounts.

However, WeChat doesn’t provide an option to view the WeChat ID of the followers, therefore, there’s little chance of having a private conversation or being able to check whether the follower is a “bot”. To overcome this, brands started adding potential followers, customers, and friends, to private group chats.

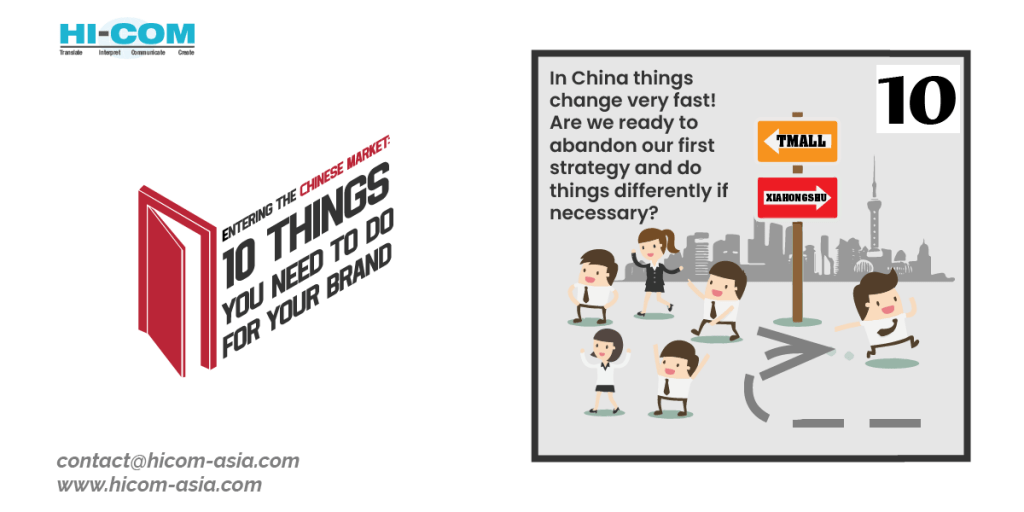

10. Be ready to react and adjust quickly

Have a flexible mindset when enter the Chinese market

A unique feature of the Chinese digital market is its fast-paced development. For example, something that was mainstream yesterday might be not an option tomorrow. However, a lot of foreign brands do not adapt to these changes, which leads to weaker product visibility and decreasing brand loyalty.

Today, in order to get a space on the Tmall platform, foreign brands must go through a detailed assessment by Alibaba’s representatives, in order to find out whether they’ll have a “fighting chance” on this platform. This includes an analysis of the brand’s mindset. Only flexible and adaptable brands” are able to receive a green light and join the platform.

Another example that comes from one of our client’s in snack import sector. After being on the market for 2 years, they started to receive comments and requests from few large wholesalers about minimizing their packaging to a pocket size of 50g. and mixing all the flavors of snacks in these mini packages. Being able to handle such requests (that developed to orders), the brand was able to grow their sales a solid 39% within that year, and 80% in the year after that.

How to get a strong China market entry strategy that is tailored for your business, resources and KPIs made by professionals? Follow these few steps:

- Send email request to our managers, specifying your needs

- Get a detailed proposal along with lead-time and quotation

- Confirm the proposal

- Schedule a kick-off call with HI-COM’s strategist, where you can get knowledge on China market and your specific case, and provide the details of your business.

Further Reading

Banned marketing terms in China

What are the distributors in China looking for in foreign brands?

Top livestreaming platforms in China

KOL (Influencer) marketing in China: costs and best strategies

HI-COM is a localization and multilingual communication agency dedicated to providing China-specific strategy, social media communication and e-commerce marketing services to businesses around the world. Working with more than 100 brands, HI-COM is the go-to partner of companies that want to enter China market! Contact us for your free consultation today!

Scan QR code to follow Localization and The Chinese Market Entry News or Contact us on WeChat: