Chinese Social Media Strategies of Top 5 Luxury Brands in China 2020 – HI-COM

Chinese consumers, now more than ever, are the keystone of the luxury market. In 2020, strategies of luxury brands in China will be the key in determining how their brand fares globally.

According to the market analysis from the Bain and Company Luxury Study 2020 Update, 90% of luxury market growth was driven by Chinese citizens, yet 70% of luxury shopping by Chinese citizens was done overseas last year. As travel is not aviable option for Chinese citizens this year due to the global nature of the coronavirus outbreak, there is now an influx of Chinese consumers purchasing luxury products domestically.

As the first major economy to emerge from the coronavirus crisis, Chinese consumers will make up over 50% of the share of the global luxury market by 2025 according to Bain and Company. In the last few months, luxury brands in China have had to quickly pivot their marketing strategies and adapt to the new climate of post-COVID Chinese consumer habits.

What strategies have luxury brands tailored to respond to this new situation?

Engagement on Chinese Digital Platforms

In China, consumers of luxury goods are younger and more digitally aware than their Western counterparts. To gain a foothold in the market and establish a lasting presence, luxury brands in China have started to break into the fast-paced environment of the Chinese internet.

Top luxury brands have launched accounts on major Chinese digital social media platforms to establish a digital connection with their customers and thoughtfully engage with them as part of their China localization strategies.

Douyin, Tiktok’s Chinese counterpart, is China’s short video platform of choice for the post-90s generation. The most successful luxury brand on Douyin by follower and engagement, Gucci officially launched their Douyin account in April.

Gucci’s Douyin strategy consists of creating a host of hashtag challenges to encourage brand engagement, of which the Gucci Qixi (the Chinese counterpart to Valentine’s day) challenge was most successful, with over 75.3 million views, owing to smart brand localization.

Get familiar with Wechat updates with HI-COM’s What’s new on WeChat in 2020

Livestreaming fashion shows have been an unavoidable adaption to the coronavirus outbreak across the world. Exploring a different side of livestreaming, Louis Vuitton teamed up with China’s largest social e-commerce app Xiaohongshu (Little Red Book) to livestream the product presentation of their SS21 collection, tapping Xiaohongshu KOL Yvonne Ching and celebrity actress Zhong Chuxi as cohosts.

As the first luxury brand to officially launch an account on Xiaohongshu and produce interactive original livestream content, Louis Vuitton garnered over 150,000 page views and positive engagement from Chinese consumers over the course off the livestream.

However, as a new strategy for these luxury brands, there are still growing pains. Other than Gucci, top luxury brands with Douyin accounts have seen lacklustre performance. Dior and Cartier currently boast follower counts and engagement levels similar to mid-level domestic KOL’s. Some commentators also found the image quality of Louis Vuitton’s Xiaohongshu livestream unbefitting of an internationally renowned luxury brand.

To succeed in this new arena, luxury brands in China will need to find a localized voice and content to fit the format of these platforms while retaining their international brand image.

An example of a luxury brand that has succeeded in developing their own localized voice and digital content in China would be Hermès. By creating playful and gamified posts on their WeChat official account to educate consumers of their craftsmanship and products, they have garnered the attention of younger audiences without compromising brand image.

E-Commerce Integration

Just a few years ago, selling luxury goods online would have been seen as a degradation of brand image. However, since the coronavirus-imposed lockdowns, e-commerce in China has expanded with rapid pace leaving no industry untouched. Luxury brands are no exception.

And as China’s economic growth continues, there is a growing class of luxury consumers in second and third tier cities. Online channels for e-commerce have become the most important way to reach this growing cohort of customers.

Tmall, Alibaba’s B2C platform, launched their Luxury Pavilion in 2017 as an invite-only online “safe space” for luxury brands. Luxury Pavilion features the Luxury Pavilion Club for brands to provide top customers a host of exclusive benefits.

Learn more about successful strategies in our Getting ready for Double 11 in 2020: learning from Chinese brands

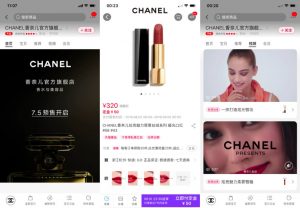

Chanel signed a partnership with Tmall to sell their makeup on Luxury Pavilion in 2019. To bring the premium feel of brick-and-mortar stores to their online shop, Chanel has integrated real-time online consultations with beauty advisors and free shipping. Their membership program also provides exclusive access to attend offline events. However, Chanel clothing is not available on Luxury Pavilion; shoppers can browse on Chanel’s official Chinese website and go in-store to buy, as luxury clothing is still seen as a product that requires tactile experience before purchase in China.

Cartier also joined Luxury Pavilion earlier this year, launching exclusive products for sale on the app including their Juste un Clou bracelet and Guirlande chain wallet bag. As a luxury jewelry brand, Cartier has made their full product catalogue available on Tmall while offering online real-time personalization services.

According to Morgan Stanley’s “Consumers of the China’s Stay Home Economy”, luxury brands in China saw sales increase by 40-90% in early June of this year. The trend of e-commerce integration for luxury brands in China will only grow as online shopping for luxury becomes part of the new normal.

Read more about other options when entering China’s e-commerce market in HI-COM’s 5 social e-commerce solutions in China besides Tmall guide!

HI-COM is a multilingual communication agency dedicated to providing China specific social media communication and e-commerce marketing services to businesses around the world. Working with more than 100 brands, HI-COM is the go-to partner of companies that want to enter China market! Contact us for your free consultation today!

Scan QR code to follow Localization and The Chinese Market Entry News or Contact us on WeChat:

OUR CHINESE SOCIAL MEDIA AND OTHER SERVICES:

- LIVESTREAMING CAMPAIGNS

- XIAOHONGSHU MARKETING

- WECHAT MARKETING

- COPYWRITING FOR CHINESE SOCIAL MEDIA, PRESS, WEBSITE CONTENT